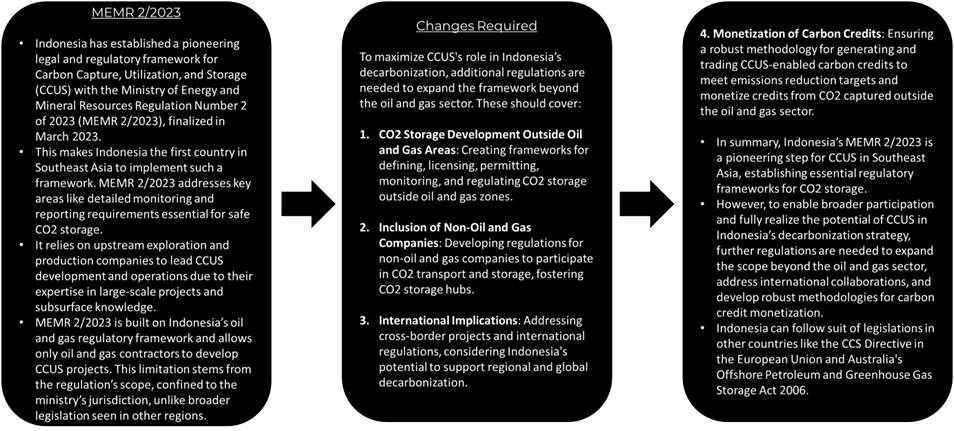

-

Subsurface Hydrogen Storage

view -

CCUS in Malaysia

view -

CCUS In Indonesia

view

Blog List

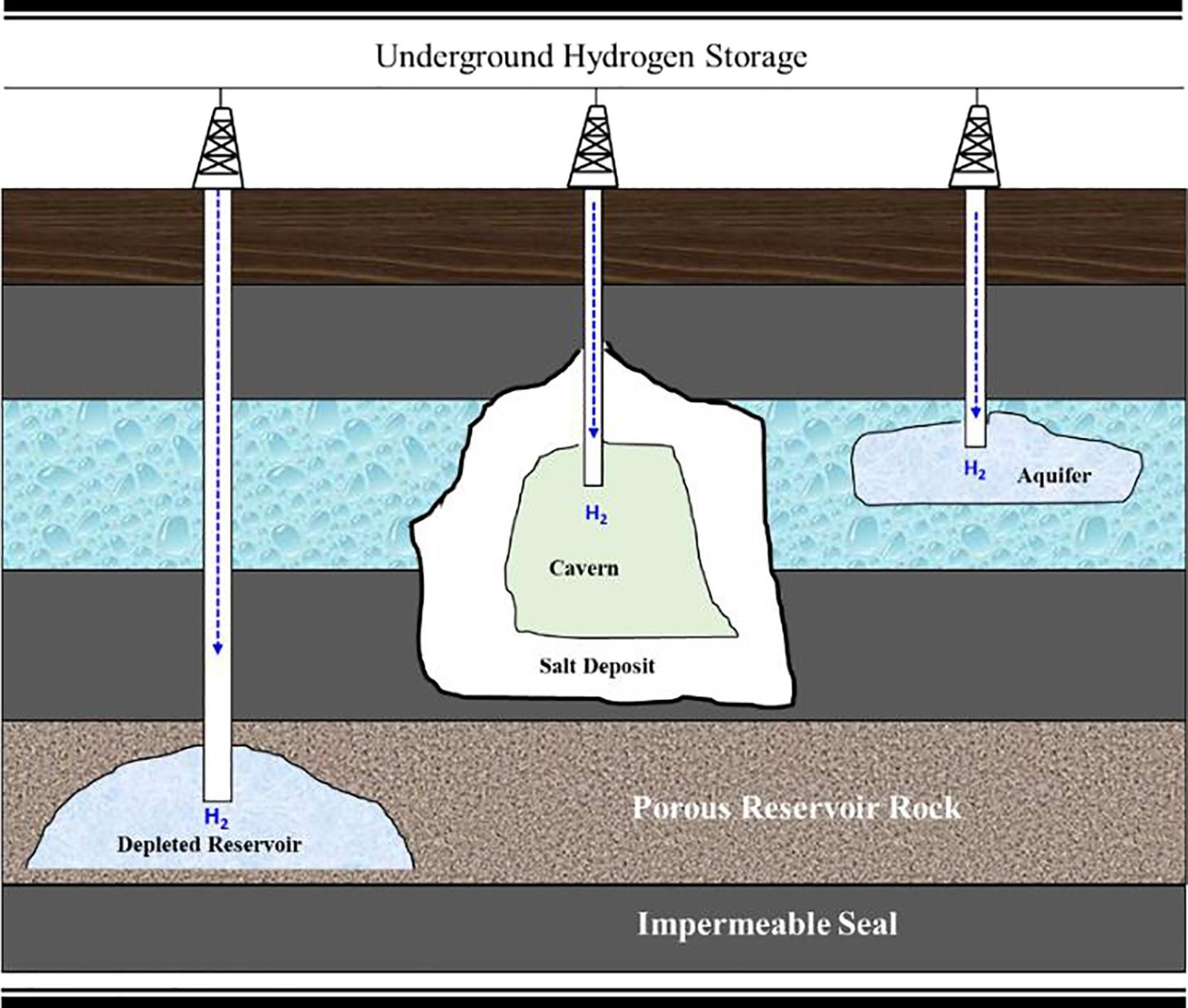

Subsurface Hydrogen Storage

Overview

Hydrogen is a clean fuel that can help cut down on greenhouse gas emissions and support sustainable energy systems. However, storing hydrogen is tricky because it has a low energy density and is highly flammable. We need effective storage solutions to keep a steady supply of hydrogen for uses like transportation and power generation. Underground storage in depleted fields and salt caverns offers unique benefits, including large storage capacity and increased safety.

1. Depleted Fields for Hydrogen Storage

Depleted fields, formerly used for oil and gas extraction, offer an excellent opportunity for hydrogen storage. These fields possess pre-existing infrastructure and geological characteristics suitable for storing hydrogen. The key advantages of using depleted fields include:

Utilization of Existing Infrastructure: Leveraging the existing wells and pipelines reduces the need for new construction, lowering costs and environmental impact.

Large Storage Capacity: Depleted fields offer vast underground spaces capable of storing significant volumes of hydrogen.

Enhanced Safety: The geological characteristics of depleted fields provide a natural barrier, minimizing the risk of hydrogen leakage.

Technical aspects of converting depleted fields for hydrogen storage involve assessing the reservoir's integrity, modifying injection and withdrawal processes, and ensuring compatibility with hydrogen's properties. Successful projects, such as the subsurface hydrogen storage initiatives in Europe, demonstrate the feasibility and benefits of this approach.

2. Aquifers for Hydrogen Storage

Aquifers are the second-most economically attractive option for geological hydrogen storage after depleted oil and gas reservoirs. For a successful storage project, a reasonably high recovery of stored hydrogen is projected. Aquifers represent the most environmentally friendly type of underground storage and are sometimes the only accessible geological formations for hydrogen storage.

Saline aquifers offer a significant opportunity for cost-effective long-term hydrogen storage due to their geographical accessibilities and storage capacities. Saline aquifers are distributed worldwide and offer higher storage capacity (hundreds of millions of standard cubic meters) compared to depleted oil and gas reservoirs. There is extensive research and field experience with natural gas storage and carbon capture and storage (CCS) operations in saline aquifers. Saline aquifers host most of the current natural gas geological storage operations in the world. Previous experiences in gas storage operations in saline aquifers provide significant hydrogeological and geological information required to evaluate the potential for underground hydrogen storage. Therefore, saline aquifers provide a unique opportunity for worldwide large-scale geological storage of hydrogen.

A suitable aquifer for hydrogen storage should have ample porosity and high permeability with an existing formation pressure. In addition, the potential aquifer must have impervious caprock, ensuring the confinement of the injected gas.

Challenges

One anticipated problem with hydrogen storage in aquifers is the high demand for cushion gas, compared to depleted gas reservoirs where the naturally occurring gas remaining in the reservoir can constitute a significant portion of the gas cushion.

The uncertainty in geological characteristics is one of the main challenges for large-scale implementation of hydrogen storage in saline aquifers. Comprehensive studies on geologic characteristics are required to accurately assess the suitability, storage capacity, and trapping capability of the target aquifer.

Hydrogen contamination with the products of hydrogen conversion such as CH4 and H2S is the other important consideration in active microbial environments. Microbial activities in a highly populated microorganism environment can lead to the formation of biofilms, which may impact the petrophysical characteristics of the storage formation, sealing caprock, and subsequently the subsurface transport properties.

3. Salt Caverns for Hydrogen Storage

Salt caverns, formed through the natural dissolution of salt deposits, provide another promising option for hydrogen storage. These caverns offer unique advantages:

High Purity and Stability: The salt formation ensures a high-purity storage environment with minimal risk of contamination.

Flexibility and Scalability: Salt caverns can be engineered to various sizes, accommodating different storage needs and scaling up as demand increases.

Excellent

Sealing Properties: The self-healing nature of

salt makes caverns highly resistant to gas leakage, ensuring

safe and secure hydrogen storage.

Developing salt caverns for hydrogen storage involves creating and managing the caverns' structure, ensuring the integrity of the storage site, and monitoring for potential environmental impacts. Successful examples, such as the hydrogen storage projects in Texas, highlight the viability and effectiveness of salt caverns in meeting large-scale hydrogen storage needs.

Technical and Environmental Considerations

Ensuring the safety and environmental sustainability of underground hydrogen storage is paramount. Key considerations include:

Safety

Measures: Implementing robust safety protocols

to prevent hydrogen leaks and explosions.

Environmental

Impact: Assessing and mitigating potential

environmental impacts, such as groundwater contamination and

land subsidence.

Regulatory

Compliance: Adhering to local and international

regulations governing underground gas storage.

Sustainability:

Evaluating the long-term sustainability and resilience of

storage sites to ensure they remain viable for future use.

Innovations and Future Trends

The field of hydrogen storage is evolving rapidly, with continuous advancements in technology and techniques. Emerging trends include:

Advanced Materials: Developing materials with improved hydrogen absorption and storage capacities.

Digital

Monitoring: Utilizing digital technologies and

sensors for real-time monitoring and management of storage

sites.

Integrated Energy Systems: Exploring the integration of hydrogen storage with renewable energy sources like wind and solar for a more resilient energy grid.

Common Myths Regarding Subsurface Hydrogen Storage

Myth:

Hydrogen will quickly leak out of storage sites.

Reality:

Although hydrogen molecules are small and can diffuse through

certain materials, properly selected and well-characterized

geological formations, such as saline aquifers with impermeable

caprocks, can effectively contain hydrogen. Advanced sealing and

monitoring technologies also mitigate leakage risks.

Myth:

Subsurface hydrogen storage is too expensive to be practical.

Reality:

While initial costs for developing storage infrastructure can be

high, economies of scale and technological advancements are

reducing these costs. Additionally, the long-term benefits of

large-scale hydrogen storage, such as energy security and grid

stability, can outweigh initial investments.

Myth:

Subsurface hydrogen storage is a completely new and untested

concept.

Reality:

The concept of storing gases underground is well-established,

with decades of experience in natural gas storage. While

hydrogen has unique properties, research and pilot projects are

continuously advancing our understanding and capabilities in

this area.

Myth:

Subsurface hydrogen storage is not needed due to advancements in

other storage technologies.

Reality:

While battery and other storage technologies are advancing,

hydrogen storage offers unique advantages, particularly for

long-term and large-scale energy storage. It complements other

storage solutions and plays a crucial role in a diversified

energy storage strategy.

Rara Energy Consulting is at the forefront of these innovations, actively participating in research and development initiatives to push the boundaries of what's possible in hydrogen storage.

At Rara Energy Consulting, we pride ourselves on our expertise in hydrogen storage solutions. Our team has successfully executed numerous projects, showcasing our ability to deliver safe, efficient, and sustainable storage solutions. From advanced modeling techniques to optimize storage capacities to ensuring regulatory compliance, our comprehensive approach ensures the highest standards of safety and performance.

Hydrogen storage is essential for the renewable energy landscape, paving the way for a cleaner and more sustainable future. Storing hydrogen underground in depleted fields and salt caverns offers a strong and scalable solution to meet the increasing demand. Using these methods, we can maintain a reliable and efficient supply of hydrogen, helping to drive the shift to a greener energy system.

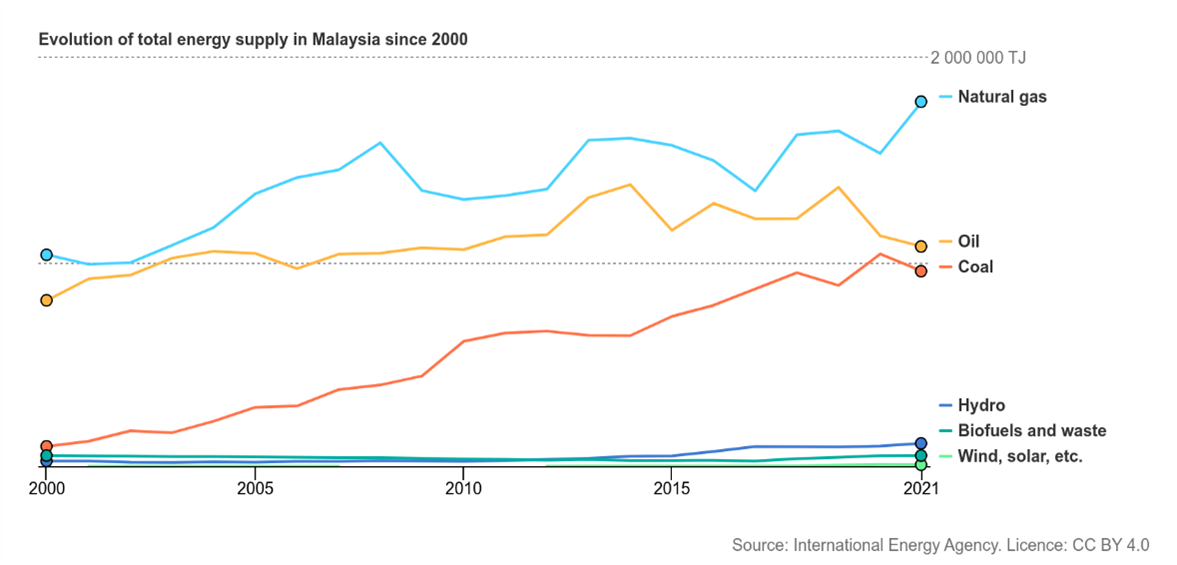

Malaysia’s Current Energy Mix

- continue to contribute the largest share (~95%) of Malaysia’s energy supply and have a significant influence in shaping the country’s energy landscape.

- As of 2020, four energy sources dominated the national total primary energy supply (TPES) mix.

- Natural gas constituted the largest portion at 42.4%, followed by crude oil and petroleum products at 27.3% and coal at 26.4%.

- Renewables, comprising hydropower, solar and bioenergy, constituted just a mere 3.9%.

Malaysia’s Storage Potential

- Malaysia has significant potential for carbon capture, largely due to the nearing end of life for several oil and gas fields. According to data from Malaysia Petroleum Management (MPM), the country’s 16 depleted oil fields have a carbon storage capacity exceeding 240 million tonnes.

- Coupled with local expertise and policy support, Malaysia is poised to become a transnational carbon storage hub for major markets like Australia and Japan.

- Estimates place Malaysia’s total offshore CO2 storage potential at 500 metric tonnes, presenting the possibility for the development of more projects like Kasawari

- Eleven of these 16 potential CCS sites are at fields offshore Sarawak while the other five are located offshore Peninsular Malaysia.

- In addition to offering storage solutions for domestic projects, Malaysia will make its excess storage capacity available to third parties, thereby establishing the nation as a regional CCS hub.Sixty% of the storage capacity will be allocated to Malaysia for Petronas and partners while the remaining 40% will be made available to other countries.

Projects

Lang Lebah Gas Field CCUS Project (PTTEP)

- The Lang Lebah gas field is located in block SK410B, 90km off the coast of Miri, Sarawak, Malaysia. It is the largest gas discovery near Malaysia, made by PTT Exploration and Production Public Company (PTTEP), a wholly owned subsidiary of the Petroleum Authority of Thailand (PTT).

- The Lang Lebah field is expected to come on stream in 2027 and will produce up to one billion cubic feet (Bcf) of gas per day. The field is estimated to hold five trillion cubic feet (Tcf) of gas in place. This project will also involve the removal of hydrogen sulphide (H2S) in addition to CO2.

- Produced gas from Lang Lebah will flow via pipeline to an onshore processing plant dubbed OGP-2, and the extracted CO2 will then be piped back offshore for injection at the depleted Golok field.

Kasawari Carbon Capture and Storage Project (PETRONAS)

- The Kasawari gas field is estimated to contain 3.2 trillion cubic feet (tcf) of natural gas resources. It is expected to produce 900 million standard cubic feet per day (mmscfd) of gas and 3.5 million barrels of condensate per day, with production commencing in 2023.

- Petronas reached a final investment decision (FID) for the development of the Kasawari carbon capture and storage (CCS) project in November 2022. The CCS project is expected to capture up to 3.3 million tons (Mt) of carbon dioxide equivalent emitted by flaring at the gas field each year.

- For Petronas Carigali’s Kasawari phase 2 project, the nation’s maiden CCS development, the extracted and compressed carbon dioxide will flow approximately 135 kilometers via a pipeline to the M1 field, where it will be injected into a depleted reservoir.

- Malaysia’s national oil company claims that Kasawari will be the largest offshore CCS project in the world when it starts, with 4 million tonnes of carbon dioxide to be captured annually. A total of 76 million tonnes of CO2 from Kasawari will ultimately be injected at the M1 field, with the first injection targeted for the fourth quarter of 2025.

Major Collaborations Signed

Kasawari Carbon Capture and Storage Project (PETRONAS)

SHELL: Anglo-Dutch supermajor Shell is teaming up with Malaysian state-run giant Petronas to explore potential carbon capture and storage (CCS) opportunities in Malaysia. Petronas confirmed on Tuesday that it had signed a joint study and collaboration agreement with Sarawak Shell to explore CCS opportunities and project collaborations.

Japan Petroleum Exploration: Malaysian state-run oil giant Petronas has partnered with Japan Petroleum Exploration (Japex) to pursue carbon capture and storage (CCS) opportunities. The pair signed a memorandum of understanding late last week that will see the two companies carry out technical maturation activities to unlock potential CCS solutions, including suitable carbon dioxide storage locations in Malaysia.Petronas is hoping to leverage Japex’s experience with the Tomakomai CCS Demonstration Project in Hokkaido, Japan. Tomakomai is Japan’s first full-chain CCS project that captured roughly 100,000 tonnes of CO2 per annum from a coastal oil refinery from 2016-2019 and stored it in two nearby offshore saline aquifers for storage and monitoring.

Exxonmobil: Malaysian national oil company Petronas has signed an agreement with ExxonMobil to jointly explore carbon capture and storage (CCS) technologies to help decarbonise Malaysia’s upstream industry and to provide carbon dioxide storage solutions for the region.

Posco International: Malaysian state oil company Petronas has initialled a memorandum of understanding (MoU) with a pair of South Korean steel companies to explore opportunities in carbon capture and storage technologies as well as carbon dioxide storage solutions in Malaysia. According to Petronas, the MoU with Posco International Corporation and Posco Engineering & Construction will see the trio "assess opportunities to unlock CCS potential and identify suitable technology within the scope of carbon capture, transportation of CO2 and storage for potential application.

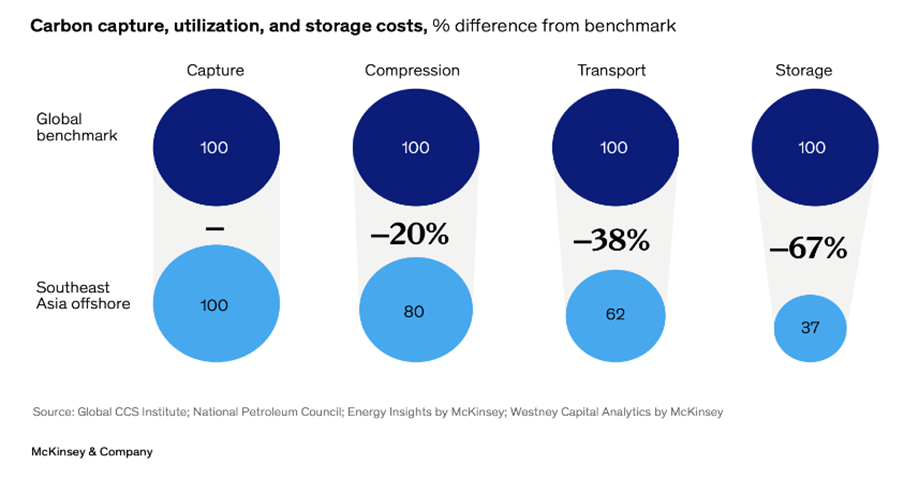

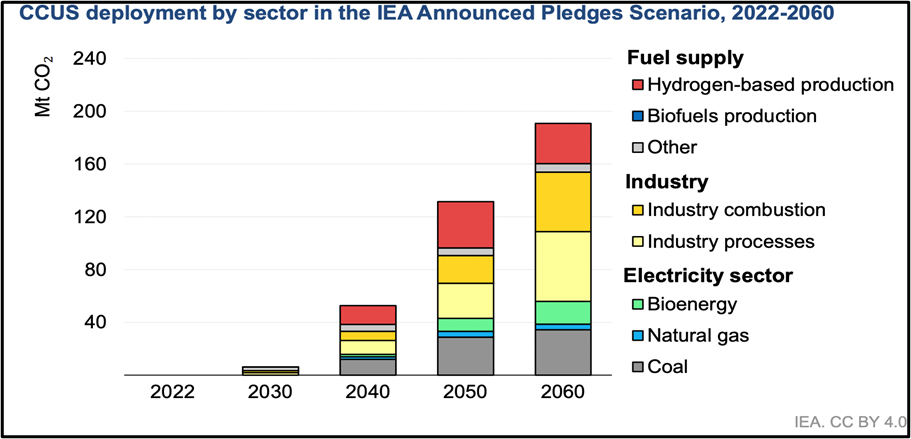

- Asia–Pacific could account for 55 percent of global carbon capture, utilization, and storage by 2050

- However, unlocking CCUS potential in Asia–Pacific is not an easy task. To realize its potential, the region needs to deliver exponential growth: at least 450 times its current operational CCUS projects. It is also characterized by inequitable access to viable domestic underground storage, and varying levels of regulatory maturity.

- The costs in Asia-Pacific are comparable to global benchmarks at the capture stage, and the rest of the CCUS value chain is even more cost-efficient. Most significantly, costs at the storage stage are estimated to be 65 percent lower than the global average

- The Asia–Pacific region faces significant challenges in scaling up Carbon Capture, Utilization, and Storage (CCUS):

- Access to Sequestration Sites: Major industrial emitters in Japan, Korea, Taiwan, and Singapore, with combined annual CO2 emissions of 840 million tons, lack nearby viable sites for CO2 storage.

- Regulatory Support: The region scores an average of 34 on the Global CCS Institute readiness index, behind Europe (41) and North America (71). More comprehensive government policies and regulations are needed for effective CCUS deployment.

- Technical Expertise: Outside the oil and gas sector, technical understanding of CCUS is low. The region lacks sufficient pilot and operational projects to demonstrate technological readiness and de-risking processes.

- These challenges are why the Asia–Pacific region is not technically ready for CCUS at the same level as North America and Europe.

Indonesia’s Path to Carbon Neutrality

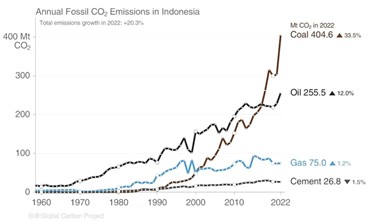

- Indonesia’s current energy is dominated by fossil fuels (coal, crude oil, and natural gas), which meet around 84% of the national energy demand, with coal being the largest source of CO2 emissions, accounting for one-third of annual CO2 emissions.

- With a potential CO2 storage capacity of 400 to 600 gigatons in depleted reservoirs and saline aquifers, Indonesia stands at the forefront of the green industrial era. This potential allows national CO2 emissions to be stored for 322 to 482 years, with an estimated peak emission of 1.2 gigatons of CO2-equivalent in 2030.

- To meet rising energy demand, the country faces a choice: either utilize more of its domestic coal resources while importing energy from international oil and gas markets, or pursue renewable sources that can provide local and affordable alternatives to fossil fuels.

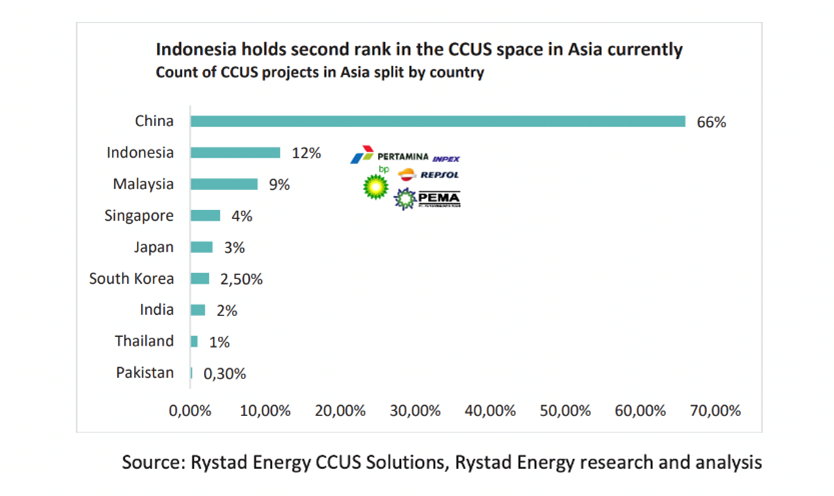

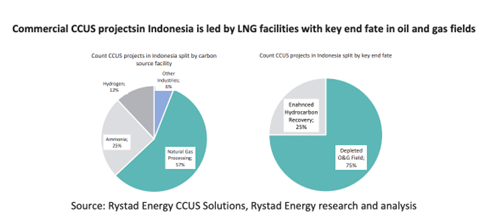

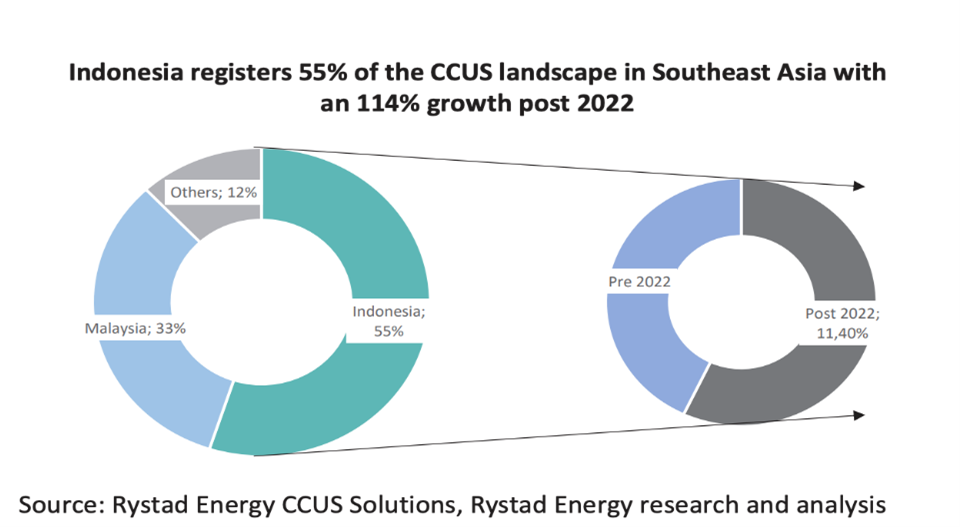

- Even if Indonesia uses only its depleted oil and gas fields, it still has a staggering storage potential of 8 gigatons. Indonesia is currently at the forefront of the commercial CCUS landscape in Southeast Asia, comprising 55% of the total projects, followed by Malaysia with 33%.

- Studies show that transitioning to renewable energy is cheaper, with the share of renewable energy expected to reach two-thirds of the country’s energy mix by 2050, up from just 14% today. CCUS will play a crucial role in facilitating this transition from fossil fuels to renewable energy, given Indonesia’s significant storage capacity.

- Statistically, from 2022 onward, Indonesia has registered a massive 114% growth in new CCUS project announcements compared to the pre-2022 timeframe. The country is expected to require only half of its storage capacity of 8 gigatons in depleted reservoirs, with an additional 400 gigatons of storage capacity available if it utilizes its saline aquifers.

- Indonesia can leverage its vast CO2 storage capacity to provide safe storage for CO2 from countries like Japan, South Korea, and Singapore.

- Partnerships with companies like Pertamina highlight the potential for Indonesia to establish a carbon storage hub, creating a viable business market. This could generate revenue by offering CO2 sequestration sites to foreign countries seeking favorable storage locations.

- Indonesia has issued a presidential regulation regarding carbon capture and storage (CCS), allowing CCS operators to set aside 30% of their storage capacity for imported carbon dioxide. The Indonesian government will collect royalties from storage fees charged by the CCS operators.

- To store carbon from overseas, Indonesia will only permit emitters that have invested in the country or are affiliated with companies that have done so. Additionally, the government must have a bilateral agreement with the government of the country from which the emissions originated.

- Indonesia is currently at the forefront of the commercial CCUS landscape in Southeast Asia, comprising 55% of the total projects, followed by Malaysia with another 33%.

- Since 2022, Indonesia has registered a massive 114% growth in new CCUS project announcements compared to the pre-2022 timeframe.

- Statistically, a 200% growth in new projects can be expected in the coming years as alliances materialize into full-scale commercial projects. This is likely to play a pivotal role in shaping the national CCUS landscape significantly.

- Forty percent of the total CCUS projects in the country are dominated by Indonesia's state-owned oil company Pertamina, followed by other companies including Repsol, BP, and Inpex.

The Rise of CCUS in Indonesia

Energy Ministry data indicates there are 14 CCS and CCUS projects in various Stages of Preparitions in Indonesia with a combined investment of nearly US$8 billion, including BP's projects

Exxon Mobil plans to invest up to $15b to develop petrochemical project and carbon capture and storage (CCS) facilities in Indonesia

Indonesian state energy company Pertamina and Exxon also agreed to assess investments of $2b for the development of CCS facilities utilising two underground basins in the Java Sea.

Pertamina said that the proposed CCS hub will have potential storage capacity of at least three gigatons of carbon dioxide (COz).

BP expects that completion for Tangguh is targeted for 2026 or 2027 and, by that time, 4 million metric tons of carbon dioxide will be injected back into the reservoir annually, with the amount reaching a total of up to 25 million metric tons of carbon dioxide by 2035 and 33 million metric tons by 2045.

He added that through enhanced gas recovery and by sequestering the carbon dioxide, Tangguh operators will potentially gain up to 300 billion cubic feet of incremental gas in 2035 and as much as 520 billion cubic feet in 2045.

Tangguh is the largest gas producer in Indonesia, generating 1.4 billion standard cubic feet of gas per day, or up to 20% of the country's daily gas production. BP and its partners are working on increasing Tangguh's production capacity to 2.1 billion standard cubic feet of gas per day.

Future of CCUS in Indonesia

- 57% of the carbon sources associated with CCUS projects come from natural gas processing facilities.

- The remaining 43% come from various industries, including ammonia production, paper production, and other chemical industries.

- CCUS is still lacking in one of the most emission-intensive sectors: power plants.

- Over a third of Indonesia's energy sector emissions come from the power sector, with 85% of emissions from coal-based generation. The average age of the coal fleet is 13 years, and new plants continue to be built.

- Supercritical and ultra-supercritical power plants, which constitute about 20% of Indonesia's coal fleet, are more efficient and suitable for CCUS retrofits. These large-scale, recently built plants could serve as anchor projects for developing CO2 storage hubs.

-

Cement Production

1. Largest industrial emitter in Indonesia, with two-thirds of the sector’s direct emissions originating from clinker production.

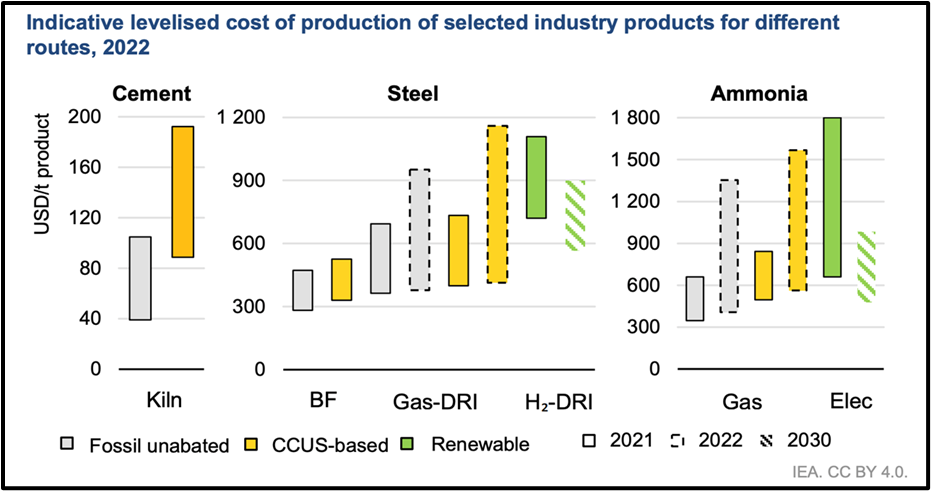

2. 30 major cement plants, which emit around 45 Mt CO2 per year. - Iron and Steel Production class="list-group-numbered modifier class "> 1. CCUS can be a cost-effective route to decarbonize. 2. 6 large-scale steel mills with annual CO2 emissions of around 30 Mt CO2.

-

Ammonia Production

1. CCUS can also be a cost-effective solution for low-emissions ammonia production. Japan and Indonesia signed a Memorandum of Cooperation (MoU) in 2022, leading to a joint CCUS study on a 0.7 Mt ammonia plant in Central Sulawesi.

CCUS Framework - Indonesia